Annual report 2022

Notes on the performance of the financial statements (EUR million)

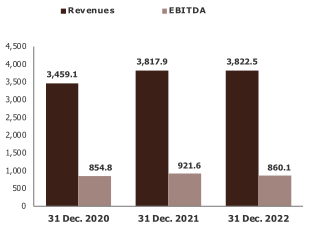

The main economic, capital and financial indicators are summarised in the following table:

| INCOME STATEMENT FIGURES | 31.12.2021 | 31.12.2022 | % Change vs. 31.12.2021 |

| CONSOLIDATED REVENUES | 3,817.9 | 3,822.5 | 0.1% |

| EBITDA | 921.6 | 860.1 | -6.7% |

| % of revenues | 24.1% | 22.5% | |

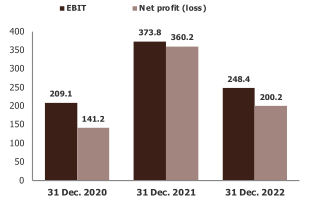

| EBIT | 373.8 | 248.4 | -33.5% |

| % of revenues | 9.8% | 6.5% | |

| Net profit from continuing operations | 648.9 | 395.8 | -39.0% |

| % of revenues | 17.0% | 10.4% | |

| Group net profit/(loss) | 360.2 | 200.2 | -44.4% |

| % of revenues | 9.4% | 5.2% | |

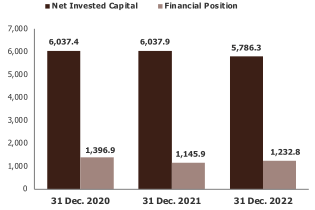

| BALANCE SHEET FIGURES | 31.12.2021 | 31.12.2022 | Change in amount vs. 31.12.2021 |

| Net invested capital | 6,037.9 | 5,786.3 | (251.6) |

| Shareholders' equity – Group and non-controlling interests | 4,892.0 | 4,553.5 | (338.5) |

| Financial position (surplus)/deficit | 1,145.9 | 1,232.8 | 86.9 |

| CASH FLOW STATEMENT FIGURES | 31.12.2021 | 31.12.2022 | Change in amount vs. 31.12.2021 |

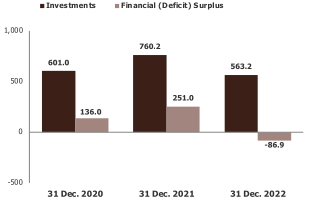

| Financial surplus/(deficit) | 251.0 | (86.9) | (337.9) |

| Investments | 760.2 | 563.2 | (197.0) |

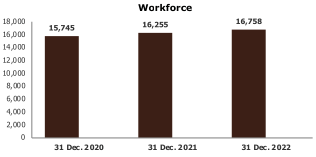

| WORKFORCE | 31.12.2021 | 31.12.2022 | Change in number vs. 31.12.2021 |

| Workforce (year-end No.) | 16,255 | 16,758 | 503.0 |

Revenues

Revenues

The consolidated revenues for the reporting period 2022 of the Fininvest Group amounted to EUR 3,822.5 million and are in line with the EUR 3,817.9 million in 2021.

The MFE Group reported revenues of EUR 2,801.2 million, down 3.9% on the EUR 2,914.3 million for the previous year; Mondadori Group revenues amounted to EUR 923.8 million, up 12.7% compared to EUR 819.8 million in 2021.

EBIT

EBIT

EBIT was positive at EUR 248.4 million, with an incidence of 6.5% on revenues, compared to the positive EBIT of EUR 373.8 million in 2021 (9.8% on revenues), with a decrease in EUR -125.4 million, partly due to the absence of non-recurring positive components recognised in 2021 and to the write-downs made in 2022 to some intangible assets, following impairment. In particular, the MFE Group recorded a positive EBIT of EUR 280.1 million, compared to EUR 418.0 million in 2021 (-33.0%), and a profitability on revenues down from 14.3% in 2021 to 10.0% in 2022. The Mondadori Group recorded a positive result of EUR 72.7 million, compared to EUR 45.2 million in the previous year.

Net profit from continuing operations

The net profit/(loss) from continuing operations was a profit of EUR 395.8 million compared to EUR 648.9 million for the previous year. Under EBIT items, the balance of financial expenses/income showed a positive balance of EUR 33.6 million (compared to the positive balance of EUR 47.2 million in 2021). The result of the equity investments recorded a positive balance of EUR 181.4 million, compared with EUR 329.3 million in 2021; the most significant amounts concerned the net profit attributable to Fininvest in the Mediolanum Group, equal to EUR 158.2 million (EUR 216.4 million at 31 December 2021) and the result attributable to MFE relating to EI Towers S.p.A., equal to EUR 14.0 million, compared to EUR 99.6 million in 2021, which benefited for approximately EUR 88 million from the capital gain from the sale of Towerrtel S.p.A.

Group net profit/(loss)

The net profit/(loss) pertaining to the Group was equal to a profit of EUR 200.2 million, compared to the profit of EUR 360.2 million in 2021. The profit/(loss) due to non-controlling interests was equal to EUR 195.6 million (EUR 288.7 million in 2021).

Net financial position

Net financial position

The consolidated net financial position before IFRS 16 showed a debt of EUR 1,072.6 million, compared to a debt of EUR 962.1 million at 31 December 2021. The total financial position was instead equal to EUR 1,232.8 million, compared to a financial indebtness at 31 December 2021, amounting to EUR 1,145.9 million.

Financial surplus (Deficit)

Financial surplus (Deficit)

In 2022 has been recorded a financial deficit of EUR 86.9 million, compared to the financial surplus of EUR 251.0 million in 2021.

In the financial year 2022, the MFE Group showed a financial deficit of EUR 4.1 million, while the Mondadori Group generated a financial surplus of EUR 1.7 million. Finally, the Parent Company showed a financial deficit of EUR 70.2 million.

Investments

Investments for 2022 amounted to EUR 563.2 million (EUR 760.2 million as at 31 December 2021) and consisted of EUR 339.3 million for television and movie broadcasting rights (EUR 331.5 million in 2021), EUR 78.2 million of investments in intangible fixed assets (EUR 72.0 million in 2021), EUR 51.6 million of investments in tangible fixed assets (EUR 70.3 million as at 31 December 2021) and EUR 94.1 million equity investments, financial assets and business combinations (EUR 286.4 million in 2021).

Workforce

Workforce

The workforce at 31 December 2022 (including Mediolanum staff and sales networks) amounted to 16,758 staff members, an increase of 503 compared to 31 December 2021. MFE decreased its workforce by 31 members, while the Mondadori Group’s workforce increased by 90 members, mainly due to the effect of the new companies acquired, offset by the decreases relating to publications and activities sold in the Media area. The Mediolanum Group grew by 464 staff members (employees + sales network).

Complete documentation

To access to the complete documents of the annual or interim report, financial institutions and journalists can download materials by inserting the code of the day